AI, ML and LLM Energy Demand in Europe: A Strategic Perspective from AI Europe OS

1. Introduction: Europe at an Inflection Point Europe is entering a decisive phase in the evolution of artificial…

Homeschooling in China: Legal Constraints, Social Pressures, and the Future of Alternative Education

Homeschooling in China occupies a paradoxical position: it is formally prohibited under national education law, yet it persists…

Napblog Google Ads: The New Competitor, What It Signals for the Future of Digital Reputation.

Over the past few weeks, something interesting has started happening in the Google search ecosystem around Napblog-related queries.…

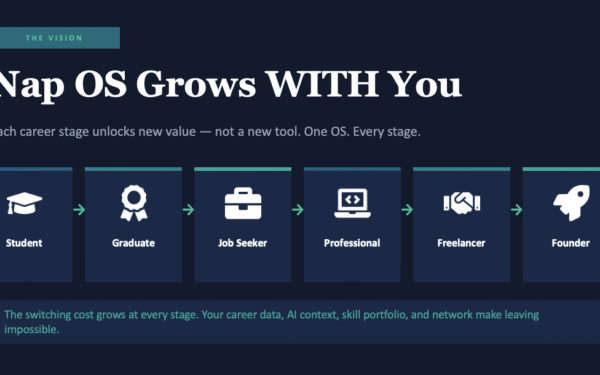

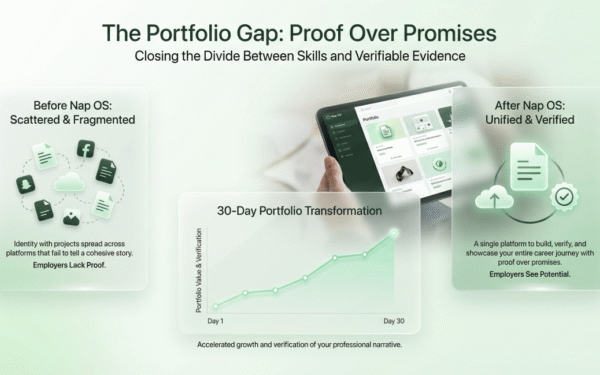

Nap OS: Structural AI Execution and Portfolio Intelligence Across Career Stages

The traditional idea of a career has collapsed.For decades, individuals progressed through predictable phases — education, employment, advancement…

Un-Conventional Actions as Underdog = GOAT

They called me the underdog before I even entered the arena.Not because I lacked ability But because I…

Nap OS ->Rewiring Hiring Beyond the Resume Economy

The hiring system most of the world still operates on was built for an industrial era that no…

Turn knowledge into execution

These articles come from real experience inside Nap OS. Start building your own verified skills today.

Try Nap OS Free

AI Agents in European Marketing: Strategic Acceleration Under Regulatory Guardrails

1. From Automation to Agency European marketing is entering a structural transformation phase. The shift is no longer…

Homeschooling in Norway: The Strategic Framework

Norway is frequently recognized for its strong public education system, high social trust, and comprehensive welfare model. Against…

Psychological Counselling for Founders to Access Intuitive Decision-Making

The Founder’s Cognitive Paradox Startup founders operate in environments defined by volatility, ambiguity, high stakes, compressed timelines, and…

Macarena Macarena

Macarena Macarena — I don’t dance for the world, I dance for myself.Not for applause, not for approval,…

More from the Napblog

Blog

Thoughts on building in public, product development, career systems, and the future of human-AI collaboration.

130 articlesNapOS

Insights, updates, and deep dives into the Nap OS platform â the career execution operating system built for students, freelancers, and founders.

66 articlesAIEOS - AI Europe OS

How AI Europe OS helps startups and SMBs navigate EU regulation, compliance, and infrastructure to build responsible AI businesses.

57 articlesSIOS - Students Ireland OS

Resources, guides, and stories for students in Ireland navigating education, employment, and career development through technology.

43 articlesHOS - Homeschooling OS

Building the operating system for homeschooling families â curriculum tracking, skill verification, and personalized learning paths.

35 articlesOut of Box Thinking

12 articlesIPOS - Intuition Psychology OS

7 articlesPugazheanthi Palani

2 articlesFrom reading to doing.

Every insight in this archive was born from real execution. Nap OS is where you make it happen.